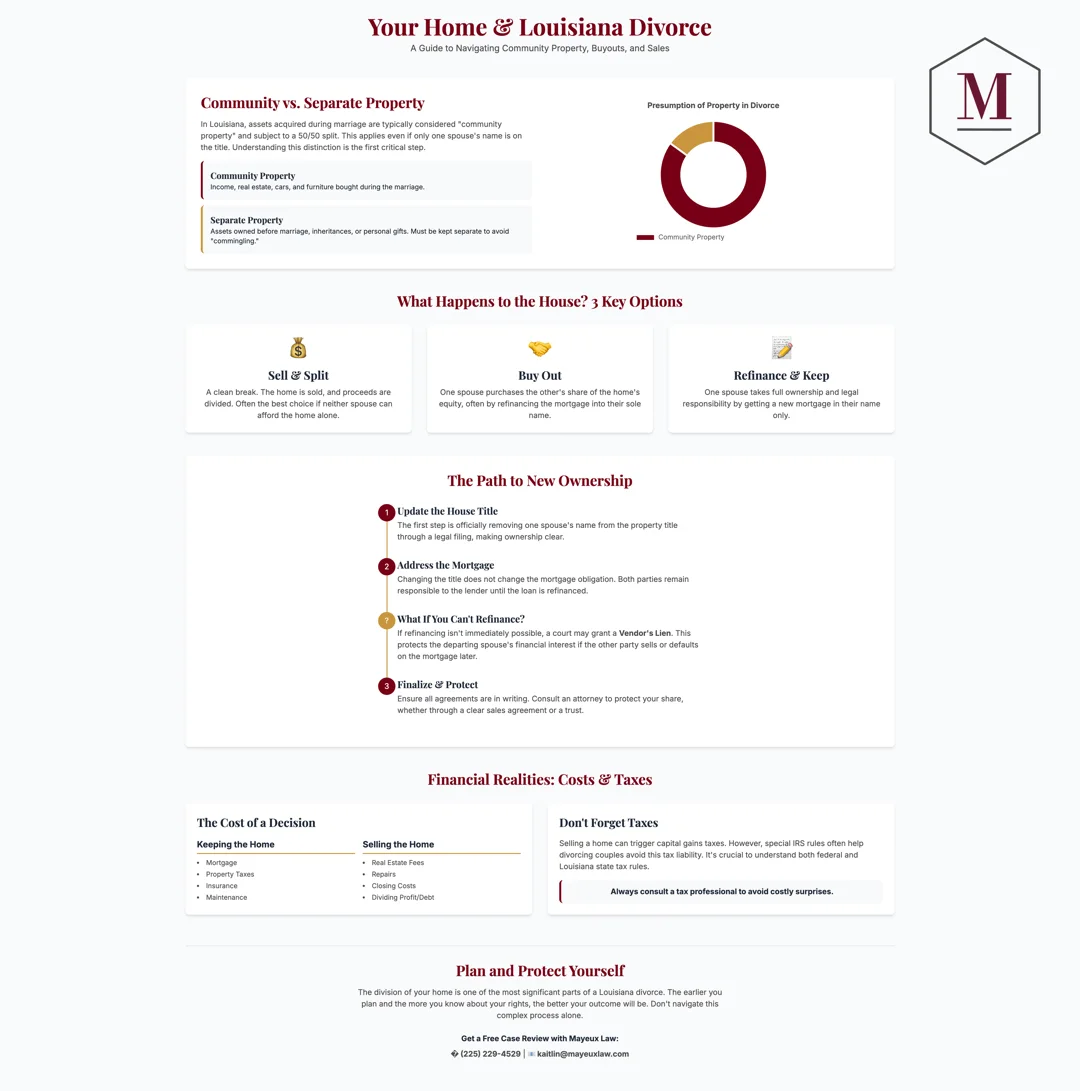

If you’re getting divorced in Louisiana, one big question is what happens to your house. Louisiana is different from most states because it follows a community property system. That means that anything you or your spouse earns or buys during the marriage is typically considered shared, even if it’s in only one person’s name. The law typically calls for a 50/50 split of these shared assets when you divorce.

There’s also a strong rule in Louisiana that says most things you get during the marriage are considered community property, unless you can prove otherwise. Even if a house or car is only in your name, it might still be shared property if it was bought while you were married. To show something is yours alone—called separate property—you’ll need solid proof, like records showing you owned it before the marriage or got it as a personal gift or inheritance.

Figuring out which assets are shared and which are separate is a key part of the divorce process, especially when it comes to your home. This step can affect how everything else is divided. If something is wrongly classified, it could mean one person gets more than they should. Louisiana law tries to make the split fair, but it doesn’t always mean cutting everything exactly in half. A judge can look at the broader context and devise a solution that best serves the interests of both parties involved.

Not everything you own during a marriage is treated the same way in a Louisiana divorce. Most things you and your spouse get while married—like income, cars, furniture, and real estate, such as the family home—are usually considered shared. This is true even if only one of you paid for it or your name is the only one on the paperwork.

Understanding the law is crucial. According to Louisiana Civil Code Article 2338, community property encompasses anything that either spouse earns or acquires during the marriage, unless it clearly falls into a separate property category. This knowledge can empower you during the divorce process.

Having clear records is your best defense. Separate property refers to assets that belong solely to you. That includes things you owned before you got married, anything you inherited, or gifts that were meant just for you. But here’s the catch—you need to be careful to keep them completely separate from community property. That means using different bank accounts, keeping titles in your name only, and having clear records that show how and when you got the asset.

If separate and shared property get mixed together, it can be challenging to distinguish what belongs to whom later on. This is called “commingling,” and it might turn something that was originally yours into something you have to split. For example, if you had a house before the marriage but used both of your paychecks to make improvements or pay the mortgage, a judge might say the home (or some of its value) is now community property.

Early legal advice can be a game-changer. To protect what’s yours, keep records, don’t mix funds, and talk to a lawyer early—especially if you’re dealing with big assets like a home. This proactive step can provide reassurance and clarity during a challenging time.

In many divorces, the house is often one of the most significant issues to resolve. There are usually three main options: sell it and split the money, one spouse keeps the house and buys the other out, or one person keeps living there and refinances the mortgage into their name.

If both people agree, selling the home during divorce can be a clean break. The house gets sold, and the profits are split based on what the court decides or what the couple agrees to. This option is often best if neither person can afford the house on their own.

Another choice is refinancing. This means one spouse takes full ownership of the house and gets a new loan in just their name. That way, the other person is no longer responsible for the mortgage. Learn more about refinancing a mortgage after divorce and what it takes to qualify for a new loan.

Keep in mind that even if the divorce papers say one person gets the house, the mortgage lender doesn’t care—both people are still legally on the hook for the loan unless it’s refinanced. That’s why it’s important to ask: Do I have to refinance after divorce?

When one person keeps the house in a divorce, you’ll need to make it official. That usually means removing a spouse’s name from the house title and filing new paperwork. This step makes it clear who legally owns the property going forward.

But just changing the name on the title doesn’t automatically remove someone from the mortgage. That’s why refinancing is such a common step — it clears up both the loan and the ownership in one move.

If one spouse is keeping the house but can’t refinance right away, the court might allow what’s called a vendor’s lien. This provides the spouse who is giving up the home with some legal protection. If the other person sells the house or stops paying the mortgage, the lien ensures they still get paid what they’re owed.

Bottom line: don’t just hand over the keys and assume everything’s settled. Ensure the paperwork accurately reflects what you both agreed upon, and consult a lawyer about ways to protect your share. This could include drafting a clear agreement about the division of proceeds if the house is sold in the future, or setting up a trust to hold the property until it can be sold.

Deciding what to do with the house isn’t just an emotional choice — it’s also a financial one. If you’re planning to keep the home, make sure you understand all the ongoing costs like mortgage payments, property taxes, insurance, and maintenance.

If you’re going to sell, you’ll need to consider real estate fees, repairs, and how to divide the profit. Knowing how these choices affect your long-term finances can help you avoid costly mistakes.

There are Louisiana laws about dividing property that outline what judges look at when making decisions about who gets what. They don’t just look at ownership — they look at what’s fair based on your entire situation.

Learn more about how splitting a house during divorce works and what it could mean for your finances moving forward. Talking with a lawyer and a financial advisor can give you a clearer picture of what’s best for you, both now and in the future.

Taxes can sneak up on you during a divorce, especially when you’re dealing with real estate. If you sell your house, you might owe capital gains taxes on home sales, but there are special rules for divorcing couples that can help you avoid them.

Depending on how the property is transferred, one or both spouses could get stuck with a tax bill. Check out this guide on avoiding taxes during a divorce settlement and consult with a tax professional who understands Louisiana law.

It’s not just about federal taxes, either. Louisiana has its own tax rules that might apply. Here’s a helpful article on tax issues in divorce or separation to help you get ahead of any surprises.

Learn more about Louisiana’s divorce options in our comprehensive guide: Divorce Options in Louisiana: A Comprehensive Guide

What happens to the home is one of the biggest parts of a Louisiana divorce. The earlier you start planning — and the more you know about your rights — the better off you’ll be. Whether you keep the house, sell it, or split the value, make sure you’ve got a clear legal plan in place.

And don’t try to figure it all out on your own. A Louisiana family law attorney can help you understand what’s fair, protect your interests, and guide you through the process step by step.

Not sure what your next step should be? Let Mayeux Law help you figure it out. Your first case review is free — no pressure, no obligations, just honest advice from a trusted Baton Rouge family law attorney. We’ll listen, explain your options, and help you feel more confident about what comes next.

📞 Call us at (225) 229-4529

📧 Or email us at kaitlin@mayeuxlaw.com

Dividing property during a divorce can feel overwhelming — especially when it comes to your house. Below are some of the most common questions we hear from clients going through this process in Louisiana.

Not necessarily. In Louisiana, most property bought during the marriage is considered community property — even if it’s only in one spouse’s name. If the home was purchased while you were married, it likely needs to be split fairly between both spouses unless it qualifies as separate property.

Yes. A buyout is one of the most common options. You’ll typically need to pay your spouse their fair share of the home’s value. Many people refinance the mortgage in their name as part of the buyout process. A lawyer can help you calculate what’s fair and handle the paperwork.

In that case, the most practical solution may be to sell the house and split the proceeds. This can give both of you a fresh start without the financial strain. Your attorney can help ensure the sale is handled fairly and that all profits and debts are properly divided.

You may want to request a court order for temporary use of the property, set up clear agreements about who pays what, or ask for a lien to protect your share. Every case is different — this is something to discuss with your lawyer early on.

Possibly, but many couples qualify for exclusions on capital gains taxes if they meet certain conditions. It’s smart to speak with a tax advisor or your attorney before selling so you don’t run into unexpected tax bills.

Still have questions? Fill out the form below to schedule your free case review. We’ll take a look at your situation and help you understand your rights, your options, and the best path forward for your family and your future.

Stay up to date with the latest family law insights, tips, and updates from Mayeux Law. Sign up for our newsletter today and get valuable information delivered straight to your inbox!